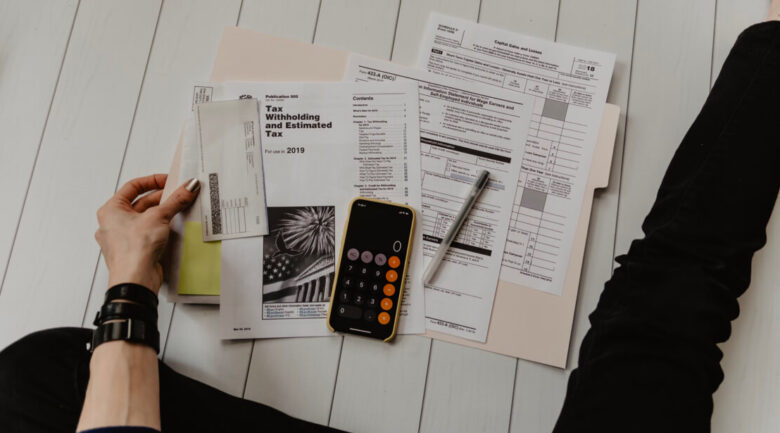

Business banks accounts can offer a wide variety of features and incentives that can make the day-to-day operation of your business that much more smooth and hassle-free. Here we take you through some of the things to consider when choosing your business bank account

What kind of business you are, and your needs

Business bank accounts can differ based on a number of factors. For example, whether or not you are a sole trader, an already established small business, or a start-up still in the fledgling stages of business formation and operation.

The important thing to keep in mind is that every bank account is different in some way. They will all offer different incentives to secure your business. Your decision will come down to a mix of what you need and the incentives on offer to use a particular provider.

For example, lets say that you’re a sole trader who has been in business for 6 months, and you currently uses a personal bank account for all business cash flow. There isn’t anything wrong with this approach, but it does require an extra level of oversight and precision when it comes to noting down your business-related expenses and outgoings. If your margins are particularly low because you haven’t built a large client base yet, you might opt for an account that offers one to two years free banking, so the transition is a little smoother.

Bank accounts such as these that offer the free banking period are usually reserved for start-ups that apply within the first 12 months, so you do have time to make the switch if you choose to. Alternative benefits to weigh between banks can include:

- Overdraft and how much, for those slightly tougher business periods

- Ability to get coins as change from a local branch, if needed

- Lack of charges on paying into your account, withdrawing, or transferring

- Availability of customer support for any issue that arises

Even with the question of what you need and your kind of business you are answered, choosing the right business bank account for you can, and often does, come down to more than just the features of the bank and the benefits that choosing them can provide.

Culture and ethics

The bank you choose might seem better on paper because they could provide a good interest rate and free electronic transactions. However, maybe you also deal with a particularly large rate of cashflow in and out, and you need your business bank account to guarantee a certain speed at responding to queries and dealing with queries, which that particular bank can’t seem to offer.

In that sense, it’s a case of taking the features and benefits hand in hand with the corporate culture and effectiveness of the providers, and weighing the two against each other.

There is also the question of how much you value the ethical standpoints behind the bank you choose. Ethical banking providers still do have to make money, but the premise they build themselves on is how they make that money. You might appreciate knowing that your money is being invested in ways that make a difference somehow. It could be from anything as simple as backing environmentally-friendly developments within the country or local community, to helping invest in eco-friendly start-ups.

It’s also important to highlight that a bank identifying itself as “ethical” doesn’t mean that they somehow offer less to you as a customer. Most banks will still be able to provide you with the services you are looking for regardless.

Whatever you’re looking for in your business bank account, weighing the pros and cons of each and giving the topic due consideration will lead you to the service and product that you feel comfortable with, making your general business operations that much easier to manage.

Via: www.sme-blog.com

Home 1

Home 1 Home 2

Home 2 Home 3

Home 3 Home 4

Home 4 Home 5

Home 5